RateSetter increase net lending to £20million

August 1st, 2012After mentioning that peer-to-peer lenders in the UK have arranged more than £300million in loans, RateSetter have now passed the £20million mark in current loans. It was only back in April when we announced RateSetter had arranged £20million in loans, now this is almost £30million, so this represents a massive 270% year on year growth.

RateSetter were the first peer-to-peer company to offer a provision fund, which would cover losses from bad debts, so lenders are not out of pocket. The provision fund has covered all bad debts to date, and can currently cover twice the predicted bad debt. To date, RateSetter have the lowest bad debt of any unsecured peer-to-peer lender, and well below estimates.

Well done to everyone at RateSetter !

Peer-to-peer lending exceeds £300million

July 31st, 2012The P2P Money website can exclusively report today that peer-to-peer lending in the UK has now passed the £300million mark in arranged loans. This is another milestone in the peer-to-peer industry which is currently growing at a rate of approximately 60% per annum.

There are four major companies operating in this arena. Zopa, who started the concept of peer-to-peer lending in 2005, is the clear leader having arranged over 73% of all loans in the UK. In second place is Funding Circle who arrange peer-to-business loans. This is followed closely behind by RateSetter who also arrange peer-to-peer loans with the additional protection to lenders of their provision fund. These top three companies are also members of the P2P Finance Association. In fourth place, but certainly not least, is ThinCats who also arrange secured peer-to-business loans.

Other companies operating in this space are One Stop Credit, YES-secure, Squirrl.com and YouAngel.

Peer-to-peer lending in the UK remains an innovative and high growth part of an otherwise depressed financial services sector.

RateSetter rebranding

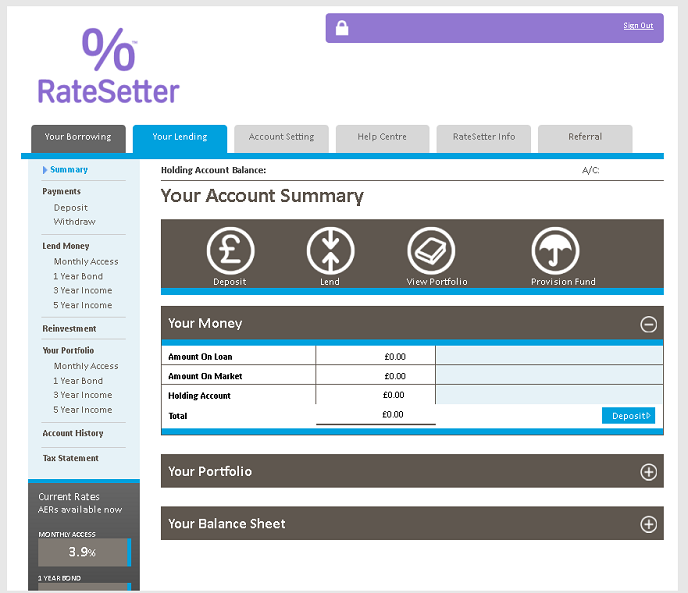

July 26th, 2012RateSetter published some screen shots of their upcoming rebranding, and from first impressions they look stunning. The mauve colour scheme has been replaced by purple, with some dark and mid greys on a white background. There is also an additional vivid blue which works very well with the purple and grey. Below is one of the screen shots.

The current RateSetter website is easy to navigate, and we look forward to using the updated design which will hopefully make it even better. The new site is planned to go live on Sunday 29th July.

Putting aside the aesthetics, the lending rates on RateSetter are still very good with 6.08% AER available in the 60 month market, and this rate is after fees, predicted bad debts and basic rate taxation. For borrowers a typical rate of 8.7 % APR available in the rolling monthly loan for a £5000 loan over 12 months. Now is an excellent time to join RateSetter.

Funding Circle 1.5% cashback

July 26th, 2012Funding Circle have yet again pushed the boat out to offer 1.5% cashback on new loans.

August is shaping up to be a fantastic month - the sun has returned, Team GB is going for gold at the Olympics and it’s our second birthday!

To kick off the party we're giving away 1.5% cashback* - simply lend to any new loan requests listed on the marketplace before 17th August 2012. With the gross yield averaging 10.5% for the last month's auctions**, adding cashback on top is going to mean a great birthday month for everyone!

This is in addition to the current £40 cashback offer if you sign up before the end of July, and lend £1000 or more by the end of September. Terms and conditions apply.

Today there rates available today in excess of 13% on the secondary market (although those don't qualify for the cashback offer) and some recent loans have seen rates in excess of 14%. Now is a great time to be a lender.

Crowdfunding vs P2P lending

July 23rd, 2012There has been a lot of coverage recently with a new peer-to-business concept called "crowdfunding". Crowdfunding is similar in many ways to peer-to-peer (and peer-to-business) lending except that as a lender you are not "lending" your money. In most cases you are "funding" the business, and receiving equity in exchange. The concept is great for start-ups and growing companies with "funders" becoming dragons (as in Dragons Den). The equity will usually be in the form of shares.

Like peer-to-peer lending there will be bad debt, in this case companies that fail. With most P2P companies, there the borrower will have some form of risk factor applied. With crowdfunding the funder needs to judge if the funding is worth the equity they are receiving. In addition the equity is only worth what someone else is willing to purchase it for. With P2P lending, as a lender you know when you will receive repayments (unless there is a default), but with crowdfunding there does not appear to be an easy exit route.

Clearly there is a big market for crowdfunding and we wouldn't want to detract from this exciting market, but unless anyone can convince us otherwisewe, we'll stick to peer-to-peer lending.