| « Zopa celebrates its 7th birthday | YES-secure delay rebranding » |

How RateSetter's bond works

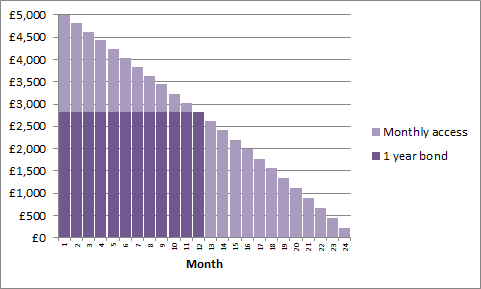

RateSetter recently introduced an 18 and 24 month loan, along with an innovative 1 year fixed rate bond which decouples the terms between lending and borrowing. This can be best demonstrated using the following examples. Lets assume a RateSetter customer wishes to borrow £5000 over 18 months, which uses the new 1 year bond. The £5000 loan will comprise just over £2000 from the 1 year bond and the remainder will come from the monthly access market.

Over the 18 month term the monthly access part will be repaid until 12 months time the only funds outstanding would be that from the 1 year bond. On the anniversary of the 1 year bond, it will be repaid to the lender and an additional sum would then be drawn from the monthly access market to take the place of the 1 year bond.

The same principle applies for the 24 month product. A similar £5000 loan will comprise a larger element (over £2500) from the 1 year bond and the remainder from the monthly access market.

The approach over 24 months is the same as for 18 months, with the 1 year bond being repaid at the end of its term. The interest rate for the borrower on the loan is fixed even though the rate on the monthly access bond is variable, but the 1 year bond is a fixed rate. This is achieved by slightly increasing the rate on the loan to offset any potential changes in the monthly access interest rates.

As RateSetter have deconvolved lending and borrowing, this could offer up some further interesting products, such as a 6 month or 24 month bond. We again have to take our hats off to the team at RateSetter for bringing further innovation to the peer-to-peer arena.