| « LendingWorks become first fully authorised major platform | LendIt Europe 2016 Day 2 » |

SavingStream confirm lower lending rates

Saving Stream has confirmed that it will be offering lower lending rates from Monday 17th October. Some loans will still be offered at 12%, but others will be below 12%. The team at Saving Stream confirmed at LendIt Europe that they were considering this approach as supply as far exceeding demand at 12%.

Here is the email send to Saving Stream customers:

Saving Stream has been offering amongst the best risk-adjusted-returns in the market to peer-to-peer investors for 4 years.

In that time, over 11,000 people have invested through Saving Stream and been paid a total of £13m in interest. To achieve that we have arranged £200m of lending, of which £70m has been returned to investors and £130m is still accruing interest. We lent over £25m in September alone and still did not satisfy the demand of our investors.

But despite that success we are always looking to improve our service based on customer feedback. One of the things investors say to us is that they want us to offer a greater number and variety of loans, giving investors more choice and more opportunities to put their money to work.

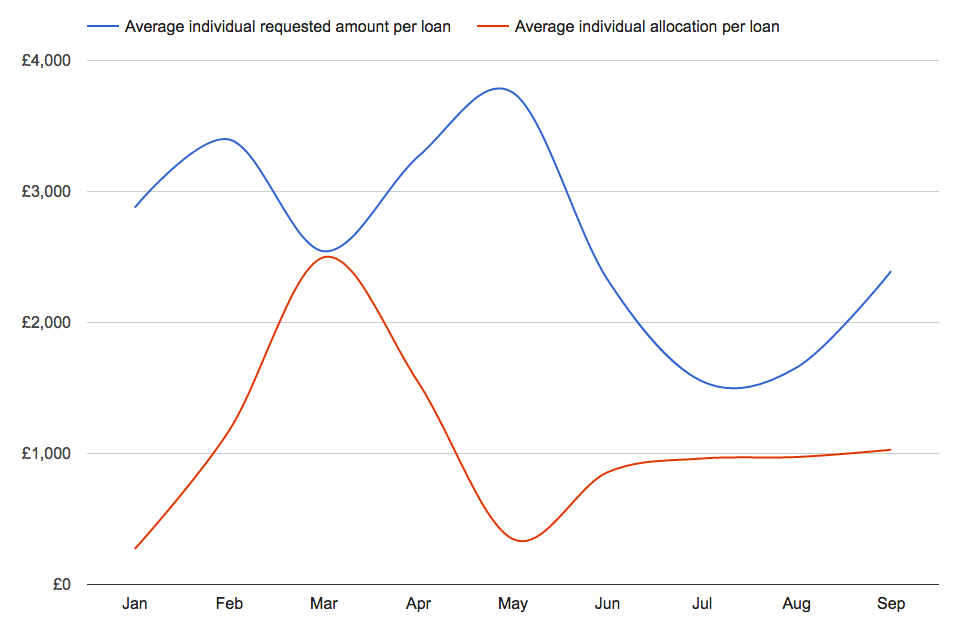

As you can see from the graph above, the requested amount for loans significantly outweighs the allocated amount that investors are receiving. We now want to bring demand and supply closer together, as fairly as possible.

In order to increase the supply of high quality loans, we intend to begin offering investors the chance to invest in lower risk loans that will pay a lower monthly rate. This will allow us to offer lower cost finance to borrowers, which should feedback to a higher volume of even higher quality loan flow.

During September alone there was an opportunity to lend at least another £25m but because our funds were too expensive we did not win the business. A higher volume of loan flow will also mean that investors are more likely to achieve their preferred allocation on the loan rather than being scaled back, which we know can sometimes be frustrating.

By investing in a wider spread of high quality loans and being able to keep their money at work more of the time, investors will find it far easier to build a sensible diversified portfolio of loans over time and probably for a similar net return as before.

We intend to start implementing this new policy from Monday 17th of October on all new pipeline loans. Please ensure your default prefunding level is set accordingly, to take into account that not all new loans will be offered at 12%.

Kind regards,

The Saving Stream Team